Does Home Insurance Really Cover Wildfires? How California Homeowners Are Protecting Their Homes

- Shawn Gardner

- 7 hours ago

- 3 min read

Why Insurance Coverage Alone Is Not Enough

Most homeowners believe their insurance will cover wildfire damage—and technically it does. However, the written coverage differs significantly from the actual protection provided.

Many California homeowners have discovered firsthand that, despite paying premiums and assuming safety, their policies fall short when fires strike.

Homeowners in Saratoga, Los Gatos, Woodside, and other areas are now taking proactive measures. They’re installing FireRoofs Wildfire Defense Sprinklers, which actively protect homes from wildfire before it’s too late.

What Your Home Insurance Actually Covers

Does home insurance cover wildfire

Your home’s structure is generally covered for wildfire damage, including walls, roof, and foundation. Detached structures like garages, sheds, or fences are included under “other structures.”

Personal property such as furniture, electronics, and clothing is covered up to your personal property limit, which may not be enough after a major fire.

Temporary Living Expenses

Insurance often covers hotels, rentals, and meals if your home becomes uninhabitable.

Most policies cover 12 to 24 months, but time passes quickly during rebuilding, making it critical to know your limits in advance.

Replacement Cost Reality

Rebuilding costs after large wildfires can double due to labor shortages and material spikes.

Without extended or guaranteed replacement cost coverage, many homeowners face a significant financial gap despite having insurance.

Zone Zero: The Most Critical Area Around Your Home

Wildfires spread via embers and flames. The area immediately surrounding your home, Zone Zero, is the most important for prevention. Protecting Zone Zero can stop embers from igniting your roof, eaves, vents, and landscaping.

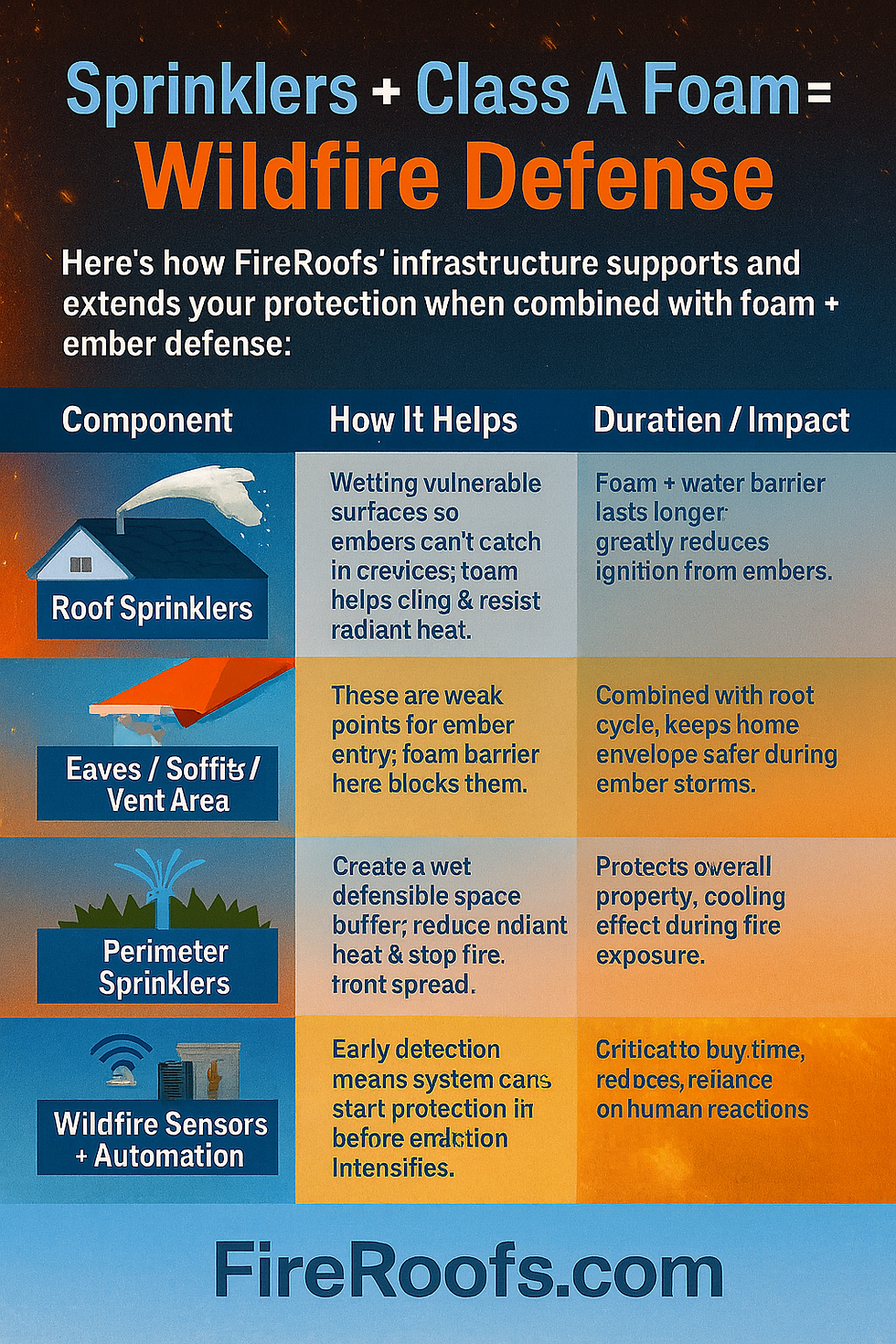

FireRoofs focuses on Zone Zero protection using:

Roof and eave sprinklers

Saturation of defensible space

Class A firefighting foam deployment

This proactive strategy dramatically increases the chances of saving your home even if nearby structures ignite.

Fire-Resistant Roofing and Defensible Space: Key Components of Protection

Your roof is your home’s first line of defense. Homes with Class A fire-rated roofing materials survive at much higher rates, and insurers reward these upgrades.

California insurers provide discounts for wildfire-hardening improvements such as fire-resistant roofs, ember-resistant vents, and non-combustible decks.

Homeowners pairing these upgrades with FireRoofs automated Wildfire Defense Sprinklers create a fully integrated defense system protecting both structure and surrounding space.

How FireRoofs Wildfire Defense Sprinklers Protect Your Home

FireRoofs is a complete wildfire defense system for California homes. It combines early detection, automated response, and active defense.

Key Benefits

Early Detection: Sensors and AI mapping detect wildfire heat, wind, and embers before flames reach your property.

Automatic Activation: Sprinklers and Class A firefighting foam deploy immediately, covering roofs, eaves, and Zone Zero.

Water Integration: The system connects to your pool, water storage tanks, or other onsite water sources.

Backup Power: Keeps the system operational even during outages.

Remote Control: Manage and monitor your system through the FireRoofs app.

This system offers continuous protection, reducing the risk of catastrophic loss and giving homeowners peace of mind.

Learn more at How FireRoofs Works.

Filing a Wildfire Claim

Acting quickly can save time and money:

Contact your insurance company immediately.

Take photos and videos of all damage before moving anything.

Keep receipts for hotels, meals, and temporary housing.

Submit proof of loss documentation promptly.

California now requires insurers to pay 60% of contents coverage upfront for total losses and allows 100 days for documentation after a state emergency.

The Bottom Line: Take Action Before Fires Strike

Homeowners insurance typically covers wildfire damage, but coverage alone is not protection.

Insurers are tightening coverage, raising rates, and leaving high-risk areas. Waiting for a payout after a wildfire is not a strategy.

The most prepared homeowners protect their homes before fires. start with:

Fire-resistant roofing

Defensible space

FireRoofs Wildfire Defense Sprinklers automatically defending Zone Zero, roof, and eaves with water and Class A firefighting foam

The best claim is the one you never have to file. Schedule a consultation now by visiting the Book a Consultation page.

Frequently Asked Questions

Does homeowners insurance cover smoke damage from wildfires? Yes. California law requires insurers to properly investigate and pay legitimate smoke damage claims. Document everything and file quickly.

What is the average deductible for wildfire claims? Many policies now use percentage-based deductibles of 2 to 5 percent of your home’s value.

Can my insurance company drop me after a wildfire claim? They can choose not to renew your policy for the next term. California’s temporary moratorium prevents immediate cancellations after disasters.

How much does FAIR Plan coverage cost? Typically, these policies are 20 to 50 percent higher than standard policies and have lower coverage limits.

What home improvements earn the largest insurance discounts?

Class A fire-rated roofing

Ember-resistant vents

Non-combustible decks

Defensible space around your home

Automated Wildfire Defense Sprinklers like FireRoofs

Comments